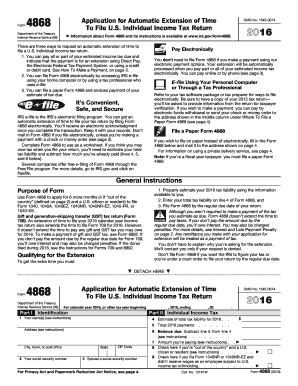

Add additional 2 weeks for paper Refund checks.Į-Filers can expect refunds about 7 to 8 weeks after receiving an acknowledgment that the state has the return. It will likely take 9–10 weeks after you e-file your tax return. Most refunds are issued within 21 days from the filed date, but it may take up to 90 days from the date of receipt by DOR to process a return and issue a refund. Most error-free e-Filed returns are processed within 5 business days of receiving the return. The processing window for selected tax returns could be up to eight weeks. No refunds will be issued before February 11.Įnhanced security measures may result in longer processing times for some tax returns and refunds. It may take up to 10-12 weeks to process and issue your refund. No specific timeline provided for delivery of tax refunds. No specific timeline provided for delivery of tax refunds.ĭirect deposit refunds will usually appear in the account two business days after the date the refund is processed. You can check the status of your refund without a login using the Where's My Refund tool. Some tax returns need extra review for accuracy, so extra processing time may be necessary. Individuals can check their status using Arizona's Where’s My Refund tool.Īnti-theft measures may result in tax refunds not being issued as quickly as in past years.Į-Filed returns will take up to 3 weeks. Processing times vary depending on e-file, paper filing, and the date the return was filed. Form 4768, Application for Extension of Time to File a Return and/or Pay U.S.Refunds are processed starting March 1 every year.Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment) Form 2350, Application for Extension of Time to File U.S.Form 1138, Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback.Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.Serving in a combat zone or a qualified hazardous duty area.Form 4868, Application for Automatic Extension of Time To File U.S.Extension Forms by Filing Status Individuals This way you won’t have to file a separate extension form and you will receive a confirmation number for your records. You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or a credit or debit card.

#FREE E FILE EXTENSION 2016 TAXES FREE#

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. You must file your extension request no later than the regular due date of your return.You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.An extension of time to file your return does not grant you any extension of time to pay your taxes.

#FREE E FILE EXTENSION 2016 TAXES HOW TO#

Need more time to prepare your federal tax return? This page provides information on how to apply for an extension of time to file. We can’t process extension requests filed electronically after April 18, 2022. To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Victims in FEMA Disaster Areas: Mail Your Request for an Extension of Time to File

0 kommentar(er)

0 kommentar(er)